January 13 2026 | Due diligence | Deals | Mergers and acquisitions | M&A Advisors

Most dealmakers still conduct due diligence the old-fashioned way, through static Excel or PDF checklists, sprawling shared drives, and email threads that require a detective to sort.

These manual actions and traditional checklists simply aren’t built for the modern age. They’re fragile, slow and can cause duplicated effort or costly compliance mistakes.

The answer is automated due diligence software like Ansarada’s Workflow tool. Workflow is built directly into the deal room to replace miscommunication, missed deadlines and team silos with clarity, confidence and control.

This article gives you a checklist framework to use immediately, and a clear use case for ditching those static files to an automated workflow that will save you time and make due diligence better than ever.

What is traditional due diligence and how is it run today?

Most boutique M&A advisors, accounting firms, financial advisors and CFOs still run due diligence manually. Think static checklists in Excel, unstructured folders, Q&A buried in multiple email threads and manual status tracking.

While these systems are familiar, they create multiple failure points:

- Missed items and gaps when lists are copied or edited

- Duplicated effort across advisors and internal teams.

- Version confusion with no single “source of truth”

- Weak audit trails or compliance gaps that buckle under scrutiny.

For advisors, this means longer hours, added stress and reputation risk. For CFOs, it means uncertainty and errors that could result in higher advisory costs down the line. And for everyone else, time spent managing the process or doing duplicated work rather than driving results.

What is automated due diligence?

Automated due diligence can be achieved through a workflow that is embedded in a deal platform that tracks tasks, documents, assignees and dates automatically.

It includes:

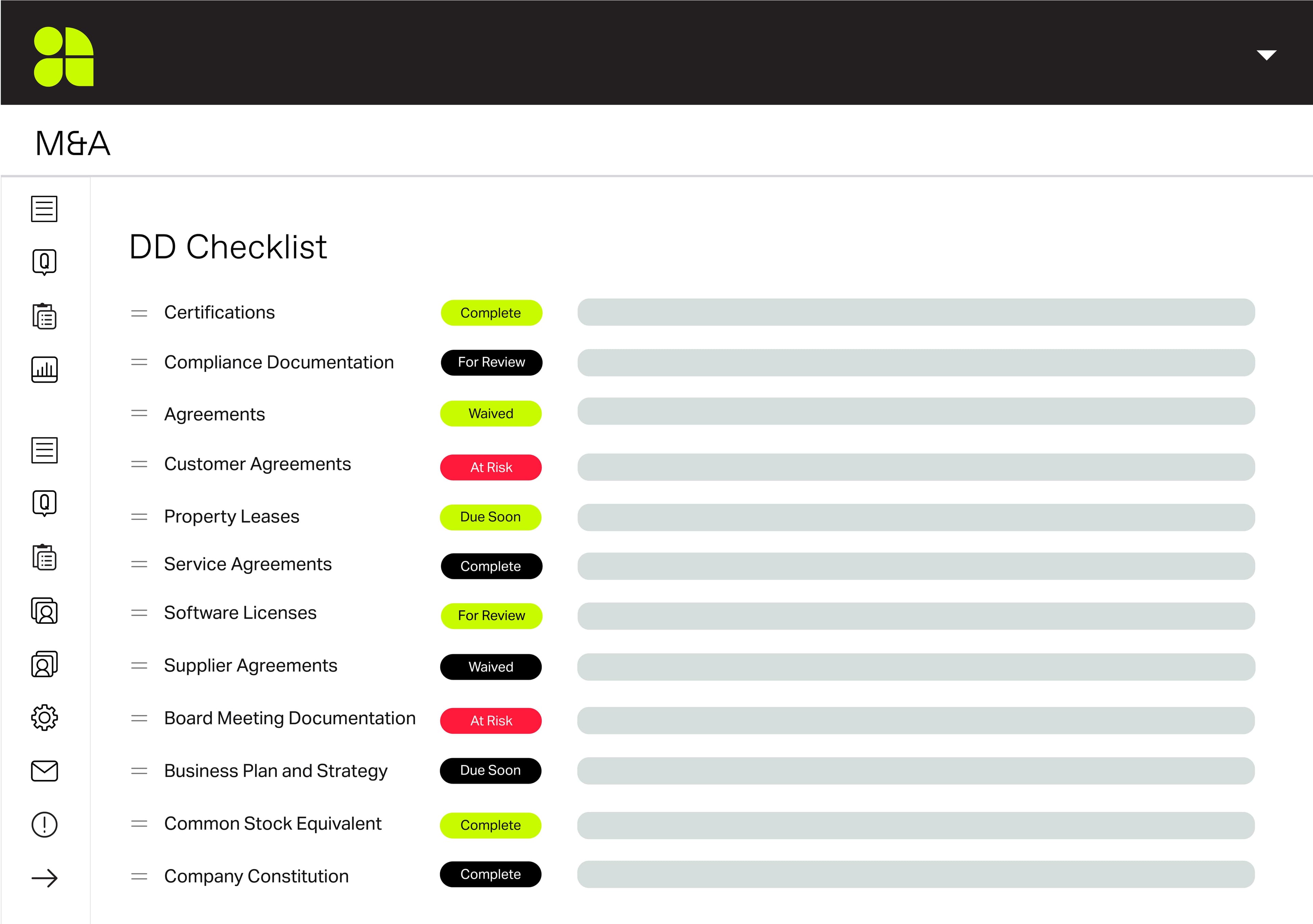

- Digitised checklists with owners, due dates and real-time status tracking.

- Centralised workspace for all documents, communications and approvals.

- Automatic history and audit logs for every action.

Ansarada’s Workflow tool brings automated due diligence directly into the deal room, so deal teams manage tasks, documents and stakeholders in one centralised command centre. Teams start with proven templates and integrated systems that maintain deal momentum and prevent anything from falling through the cracks.

Automated due diligence isn't a luxury; it’s a safeguard against missed items, delays and risk. Head to our Workflow page to learn more and get started for free .

Inside Ansarada’s Deal Workflow: How automated due diligence actually works

Ansarada’s Workflow feature brings all the pieces back into one easy-to-use place by uniting templates, timelines, collaboration tools and digitalised checklists. It replaces traditional due diligence and lifts reliability in 6 major ways:

#1 One platform, complete control

Workflow is built directly into the data room. No more juggling project managers or switching between project management tools, spreadsheets and storage platforms.

#2 Templated library and reusable processes

Capture your most successful deals as templates for deal preparation, due diligence checklists and workflow processes, then reuse them for future deals. Giving your team a head start and building up critical processes to streamline deal flow.

#3 Visual workflow management

Say goodbye to a dull workflow and hello to our interactive Gantt-style views. Visual workflows help teams see the entire deal timeline, easily identify dependencies, check progress at a glance and spot delays before they derail transactions.

#4 Collaboration tools

Ansarada’s Workflow tool comes with everything you need to cut the email chaos. It provides secure task assignment, clear priorities and collaboration inside the platform to eliminate risky email chains once and for all!

#5 Excel integration to bridge old and new

Spreadsheets are still an important part of many CFO’s and advisors' workflows. We make it easy for teams to import existing checklists and workflows from Excel, and export snapshots when needed, easing the shift away from manual methods.

#6 Digitised checklists and templates

All items are monitored through digital checklists to make tracking processes easy with systematic control over every deal component, turning these into standardised repeatable processes. So the next time you need to make a deal, there’s always a template waiting for you so you can work on what really matters.

From checklist to workflow: How to rethink your due diligence

There are several practical ways to move due diligence away from traditional manual work to automated, streamlined processes:

Make due diligence a repeatable process

Most teams start every deal with a blank spreadsheet and a fresh folder structure. Due diligence is a standardised and improvable process that automation can reduce variance and bring reliability.

The real value isn’t “making a nicer checklist”; it’s anchoring work in a repeatable process like a well-oiled machine.

Nail the core workflow components

Automation is only as useful as the components inside the workflow. A modern due diligence workflow needs:

- A clear owner for every workstream, such as financial, legal, tax, commercial, and operational

- Stages with defined entry and exit criteria, such as data requests sent or issued, logged and resolved.

- Central visibility of who is blocked, what is overdue, and where risk is building.

- An embedded audit trail that allows important compliance documents and data to be easily scraped or exported when called upon.

A good deal of workflow solutions like Ansarada’s embed these elements into the VDR so teams don’t have to duct-tape tools together.

Set a clear criterion for choosing an automated workflow platform

Setting out clear criteria for what you need from your workflow will deliver the best results. Ask important questions such as:

- Does it keep workflows, documents and Q&A in one place?

- Can we standardise and reuse our best checklists across multiple deals?

- Can we see the entire deal timeline at a glance?

- Is there a clear audit trail for approvals, changes and access?

- How quickly can analysts and associates onboard?

Ansarada’s Workflow tool ticks each box, thanks to clear status tracking for visibility, standardised templates for efficient workflows and automatic history for compliance, all integrated with our data rooms.

What “good” due diligence looks like

The ‘which version’ problem

Before: Advisor chases updates via email: there are three versions of a checklist, and no one knows which to use.

After: All requests and documents tied to structured workstreams are inside a single workflow, with status clear to the whole team. There’s no time wasted on confusion.

The ‘missed due diligence’ problem

Before: CFO discovers a missing due diligence category late in the process, pushing timelines and risking valuation

After: CFO is not blindsided due to standardised workflows and automatic version histories that make blind spots nearly impossible and show gaps early, rather than late.

Automation reduces risk, not just admin

Moving from checklists to workflows is not just about “modernising for its own sake”; it is about reducing:

- Missed or incomplete requests

- Undocumented decisions

- Last-minute surprises in board or buyer conversations

By using an automated workflow such as Ansarada’s due diligence platform, it turns a fragile spreadsheet exercise into a controlled, auditable process that minimises risk.

A smarter way to run diligence

Manual checklists are error-prone, slow and hard to audit — they’re not up to scratch for today’s modern deal environment.

Automated workflows are reliable, repeatable and transparent due diligence that protects value. It gives advisors and CFOs control, time and protects their reputation so a task never falls through the cracks.

Download the Ansarada due diligence checklist and turn it into your first workflow.

Frequently asked questions

- What is automated due diligence?

Automated due diligence uses structured workflows embedded inside a deal platform to manage tasks, documents or approvals automatically. It replaces static spreadsheets with real-time visibility and control.

- Is automated due diligence more reliable than manual checklists?

Yes, automation-first workflows provide more reliability than manual checklists. Automated workflows reduce missed items, eliminate version confusion, enforce standardisation and create an automatic audit trail.

- How do I convert my existing due diligence checklist into an automated workflow?

Users can import Excel checklists into Ansarada and map them into structured workflows or create reusable templates.

- Does automated due diligence work for smaller or one-off deals?

Even small deals benefit from clarity, repeatable structure, reduced risk of oversight and clear alignment with team members.

- How does Ansarada help with compliance and audit readiness?

Ansarada generates an automatic audit log, digitised checklists, standardised processes and report-ready outputs. Compliance-focused workflows ensure you have all the essential information for regulatory review and board reporting.