February 4 2020 | Innovation

What is a Data Room?

A data room is a secure place, either physical or virtual, used to store and share confidential documents. Access is often controlled, making a data room an ideal solution for transactions like mergers and acquisitions , due diligence, capital raising , and other processes where sensitive information must be shared with third parties.

By tightly controlling who can access the data room through verification and security settings, parties to a transaction can closely monitor who accesses the confidential information inside.

When to use a data room

A data room is highly valuable for securing and storing confidential documents. In large transactions where extensive due diligence is needed ahead of the deal, a data room is essential to securely hold and organize tens of thousands of highly confidential documents.

To ensure that all of the information is secure, organized, easy to search and discretely accessed by only those who need to see the information inside, a data room is essential.

Types of data rooms for due diligence

Traditionally, data room due diligence was conducted in a physical room. Modern data rooms are often virtual spaces, cloud-based rooms with highly secure encryption that allow granular access to documents for individuals and teams.

Traditional data rooms

A traditional data room is a secure physical space that holds hard copies of documents. The space is usually locked, guarded and monitored with security cameras, so that only those authorized to access the room can enter. A record of who entered the space is maintained for traceability. Of course, there are some flaws to this system, and it makes it challenging to conduct international transactions easily, as the parties must travel to the location of the relevant physical data rooms.

Modern data rooms

Modern data rooms are secure online spaces, often encrypted with bank-level security. These cloud-based data rooms allow digital documents to be shared, with the document owner in full control of access. Secure online data rooms are used by companies, advisors, legal teams, investors and auditors instead of traditional data rooms to make transacting easier.

A secure online data room is an essential tool for due diligence during material events like tenders, legal transactions, fundraising, and audits, where parties to the transaction can securely share confidential information. . Learn more: How Secure is a Virtual Data Room?

Key features of a data room

Whether physical or cloud-based, a data room must have the following key features to support accurate record-keeping and access control.

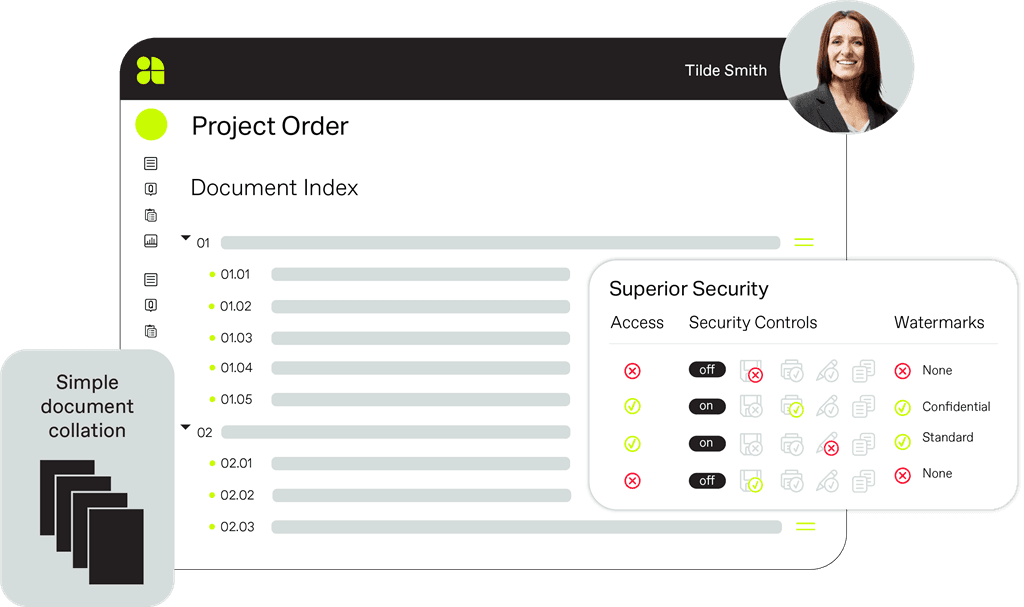

Secure access control

Access to the data room is typically controlled by the data room administrator, who specifies which users may access which documents or folders.

Encryption

An online data room is secured by encryption, which prevents unauthorized access to sensitive data. The physical alternative to encryption is the security of the room, enforced by security personnel and monitored by cameras and technology like a combination or retinal scan for entry.

Audit trails

An audit trail tracks user activity, showing who accessed which documents and when.

In a physical data room, this could be in the form of camera footage, passcode login or a physical record of who enters kept by the guard. In an online data room, the audit trail tracks who accesses documents based on the login information, IP address and other online security features.

Version control

Version control allows a record of the changes made, usually time-stamped and marked with a number. In a physical data room this is a physical record that might show when a document was redacted, edited or subject to finalisation.

In an online data room, electronic version control shows exactly when changes are made, the changes that were made, and permits reversion to a previous version if required.

Indexing and navigation

A data room is only as effective as it’s searchability or indexation system. In a physical data room, this could be a catalog containing records of all documents and their locations. In an online data room, the document index organizes documents and search functionality enables rapid searching.

Another advantage of an online data room is that access can be managed at the individual document or folder level, so only the documents an individual or team requires are shared with them. This greatly improves due diligence by streamlining the review process.

Why choose an online data room over a physical data room

Physical data rooms have major limitations:

- Searching and reviewing physical documents can be difficult and time consuming.

- Often only one person or team is allowed in the data room at a time, which means that competing bidders or even specialists on the same team have to wait for access.

- Keeping deal teams close enough to use the data room can become very expensive, especially if the due diligence process is likely to take months.

Online data rooms on the other hand:

- Can be set up extremely quickly (learn more: setting up a virtual data room )

- Can be accessed from anywhere by those that have been granted access

- Unlimited approved users can access at the same time

- Do not come with the cost of a round-the-clock human security team, as they live in a secure online environment compliant with ISO27001 (the holy grail of security accreditations)

To execute more secure deals, much faster - and with better control over multiple bidders - a secure online data room is the solution.

Ansarada’s secure online data room features advanced data room software that streamlines the due diligence process with AI-powered insights. Book a demo to find out more.

What is a data room for investors?

An investor data room is a secure space for the sharing of sensitive information relating to the company in which the investor is considering investing. Data rooms for investors used to be physical rooms, however today they are almost always virtual.

Experience the future of data rooms with Ansarada’s secure online data rooms, designed for deal-makers.

A secure online data room is a non-negotiable for modern deal-makers. Whether you simply want to organize and prepare all of your critical information or you are ready to start a due diligence process, Ansarada’s virtual data room and deal-making platform is a modern solution with all of the latest AI features.

Be a leader and start using the data room of choice for dealmakers globally.

Data room questions

What does a data room do?

A data room is a secure place to store and share documents. It allows information to be shared only with specific people and teams, eliminating the risk of unauthorized access to confidential information.

What is a data room in M&A?

Due diligence is a critical part of M&A — and a data room allows the target company to securely share sensitive information like financials, forecasting, IP and more with interested potential buyers.

Can I use Google Drive as a data room?

Google Drive might be okay if the information you are sharing is not sensitive or confidential — but to truly protect your data, while benefiting from features like bank-level encryption, automated redaction, Bidder engagement scoring and document sorting, a virtual data room is a much better solution.

Drive smarter outcomes

Confidently prepare for and achieve critical business outcomes with the world's smartest Virtual Data Room.

What is a virtual data room (VDR)?

A virtual data room (VDR) is a virtual space that acts much like a physical data room except that all data is hosted securely online with security controls over information and reporting on usage. In the days before virtual data rooms, M&A potential buyers would need to visit a physical room, in person, to review stacks of critical documents and paperwork as hard copy printouts. Today, multiple potential buyers can access confidential information simultaneously online, from any location in the world with an internet connection.

Learn more – What is a Data Room?

Why use a virtual data room?

From M&A to capital raises, audits, strategic reviews and tenders, material outcomes rely on secure virtual data rooms. So what features set a modern virtual data room apart from legacy data rooms? Here’s a closer look

More than storage and file sharing

Virtual data room software does so much more than collect, collate and store information. Modern virtual data rooms integrate with other platforms to allow two-way syncing and drag-and-drop functionality to populate a data room in minutes.

Granular access privileges, print and save controls, tracking of all actions, reporting and sophisticated Q&A enable seamless collaboration. Artificial intelligence powers and automates smart analytics on the motives and behavior behind data room activity.

More than manual labor and guesswork

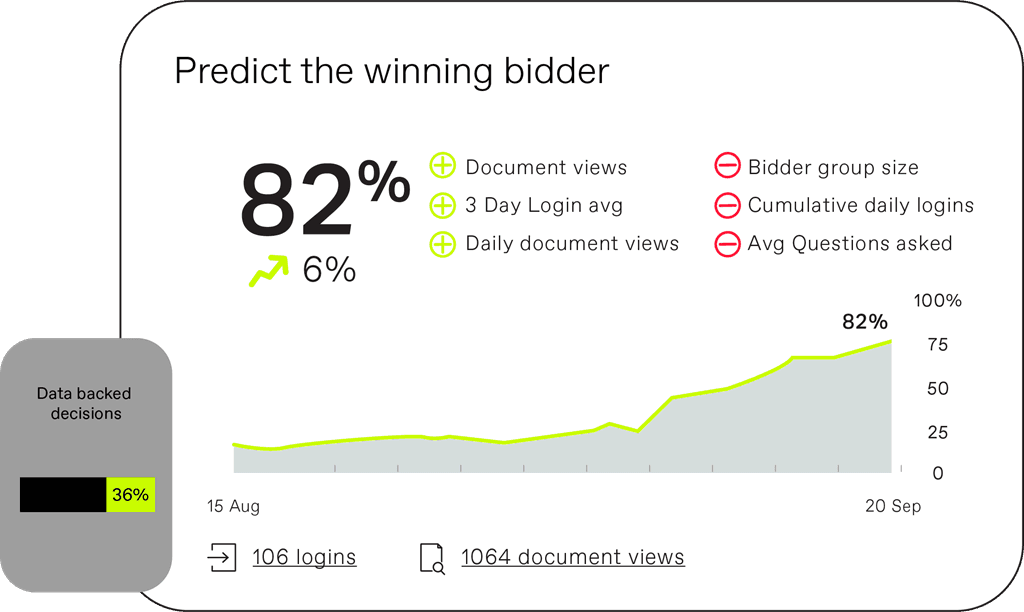

Artificial Intelligence and automated scorecards automate reporting and predict outcomes with 97% probability within seven days when you use a virtual data room to sell an asset. Workflows and processes developed by experts enable advisors and companies to prepare for deals fast and get to work immediately on driving their desired outcome. This saves significant time and money compared to generic tools and processes. Pathways are reverse-engineered from thousands of deals to outline what is required - in quantity and quality - in a path to follow for proven success in critical transactions and deals.

Only highly advanced data rooms remove the guesswork as to what documents and steps are needed for due diligence, with AI-powered features to streamline preparation and meet investor or buyer requirements.

More than a transaction tool

Modern virtual data rooms position you to get ready, run and realize value from an M&A deal, asset sale or IPO. You can leverage virtual data room capabilities to instill operational discipline, governance and risk management around material information necessary for due diligence, audits, compliance, tenders, post-deal integrations, investor reporting, and more.

Remove the frustration of legacy data rooms’ lack of functionality, lack of integration with cloud storage, complexity of use and pricing based on information volumes with a modern virtual data room that’s constantly learning and improving.

Unlimited users, unlimited possibilities

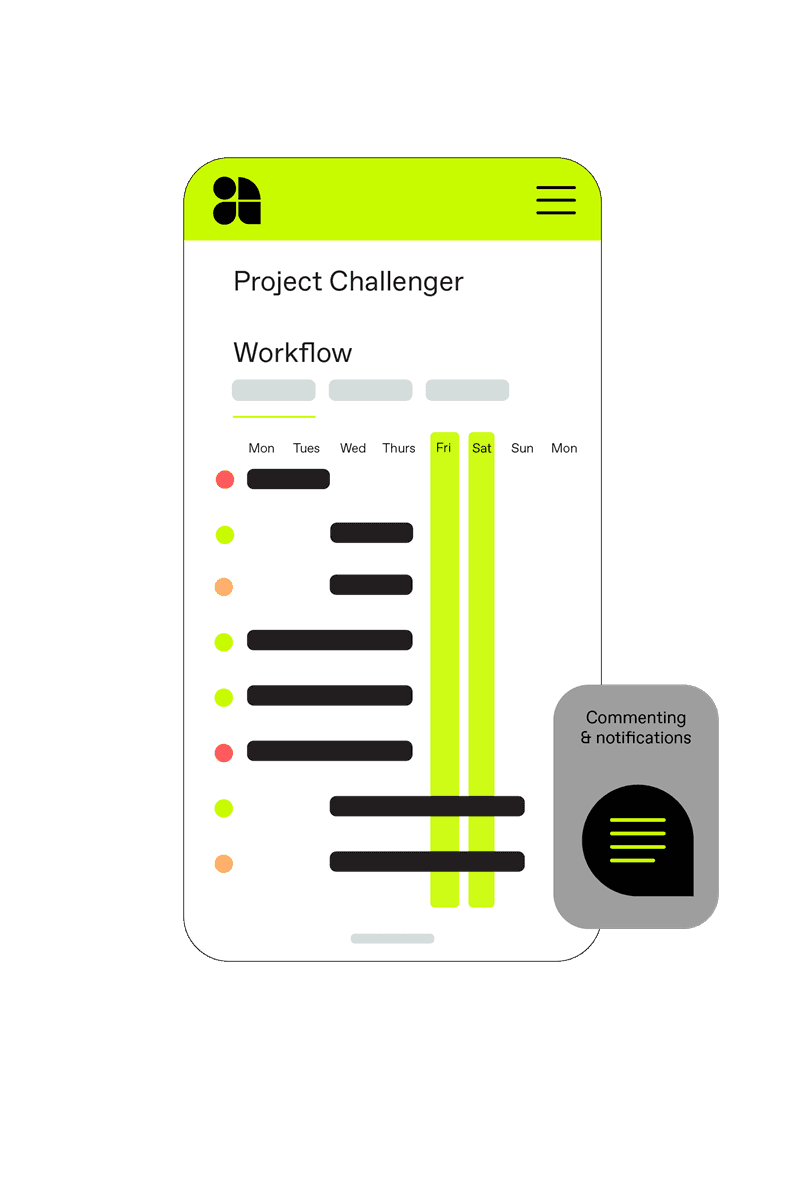

Advisors can now count on Ansarada’s Virtual Data Room as an essential tool for total transaction management across the complete deal lifecycle - from marketing to preparation to execution and post-deal integration. The Deal Workflow tool keeps all team members working cohesively and strategically, which is why our pricing includes unlimited users. Now you can invite as many users as you like.

Who uses Virtual Data Rooms?

Investment bankers: Investment banking processes like IPOs demand huge amounts of information sharing.

VCs & private equity firms: Often assessing many transactions at once, VDRs facilitate the organization and sharing of reams of data.

Auditors & regulators: Regulators use the file sharing services within a secure VDR to review and audit company information.

Lawyers: Lawyers use VDR in their day-to-day job of advising corporate clients on transactions and ensuring legal compliance.

Startups: Smart startups use virtual data rooms as online repositories of important company information so that they’re always ready for a raise.

Business leaders: CFOs are able to view all critical company information at a glance within a VDR to ensure the business is always positioned for growth.

Virtual Data Room Q&A

Got a burning question about virtual data rooms? It may have been asked already before. Find all your data room questions answered right here.

Why use a Virtual Data Room during M&A?

Data Rooms make the entire M&A due diligence process easier, more efficient and safer for everyone involved. They allow the sell-side party to keep full control over how and when information is revealed and to whom. The sell-side can also manage all communication with their bidders through the Virtual Data Room. When the deal is done, they offer a full audit trail of disclosure through a single digital archive of all activity.

What is due diligence?

Due diligence, as it relates to M&A, involves the disclosure of information by the sell-side to prospective parties. It is the process to ensure each party involved is exposed to all relevant facts before making any final decisions on the deal.

The term originated in the United States Security Act 1933, where any broker accused of inadequate disclosure was protected from liability if they could demonstrate that they had performed due diligence. Naturally, to avoid risk this practice soon became the industry standard.

It is now the norm for companies to make a legal and voluntary disclosure of all sorts of information to help potential buyers form a clear picture of their current operations and future prospects. Interested parties are then able to make informed and intelligent business decisions.

What happens during due diligence?

Documents concerning the past, present, and future prospects of the business are made available to each bidder during due diligence. The aim is to be as open and transparent as possible, while still protecting the interests of the business.

Care needs to be taken, as interested parties could include the seller’s direct competitor or perhaps a new company entering the industry. Equally, the deal may at any time fall through or be called off. In the case where the deal does successfully go through, there is a duty of care to ensure that unsuccessful bidders aren’t left with information that could be used against the new owner.

For this reason, extremely sensitive information may be held back until the final stages of negotiation when it is clear which bidders are serious about making a deal.

Learn more – Due Diligence Process

Is there really any difference between Data Room providers?

Yes! There are many products on the market that often get labelled as ‘data rooms’ but are in fact more like simple file sharing. When it comes to M&A, they are ill-equipped to offer the level of security, collaboration tools, reporting and flexibility needed in the typical high risk low trust environment of M&A due diligence with bidders who can be the selling companies direct competitors.

Products can vary from the very basic, with minimum security and rudimentary filing structure and navigation, to more sophisticated, highly secure and at times, very complex setups. Going with generic file sharing and storage tools is a false economy as the lack of features creates inefficiencies that result in higher transaction costs and waste time of busy management teams who should be maximizing focus on running the business while a transaction is occurring.

Learn more – Virtual Data Room Providers.

Why not just use a basic data room for deals like M&A?

Basic data rooms are great for sharing files between offices and disclosure.

However, during M&A when a seller wants greater control over who sees what and when, with greater visibility over potential buyer behaviour in the data room it pays to invest in a data room built with the specific M&A workflow and process in mind.

At first glance, it might seem that a simple secure environment is all that is needed to share documents during your deal. However, beyond document storage you need to consider how easy it is to upload and download documents, to integrate with Excel and email, to set security for different users, to change access quickly if the mood changes during negotiations, to shut down access in an instant if the deal is called off, to analyze reports to focus on risks, and to restrict access to some parties and not all - for instance, if a close competitor is in your data room. Even seemingly simple things like how documents are indexed and numbered can cost hours and thousands of dollars, whereas a data room can do this automatically to best practice standards that advisors and investors require.

In short, the impact on every users experience for both buy side and sell side teams translates into greater efficiency, confidence and outcomes or significant frustrations, stress, risk and inefficiency. The right tool for the job at hand is a critical decision.

What are the risks in using a file sharing system vs a fully fledged Data Room?

Simple systems are intended for simple usage. They can fast become a headache when used for anything more. Limited functionality can cause a huge waste of time and potential security issues for all involved. Learn more – How Secure is a Virtual Data Room?

Why use a data room such as Ansarada designed for deals like M&A and raising capital?

By using a specialist data room, you will find features built specifically to make the M&A due diligence process easier and more secure. What you won’t find is a bunch of stuff you will never use cluttering up the page and slowing down the system.

That means potential buyers accessing your data room will see a professional looking system where they can find the information they need to make their decision fast.

Great news if you are the one selling!

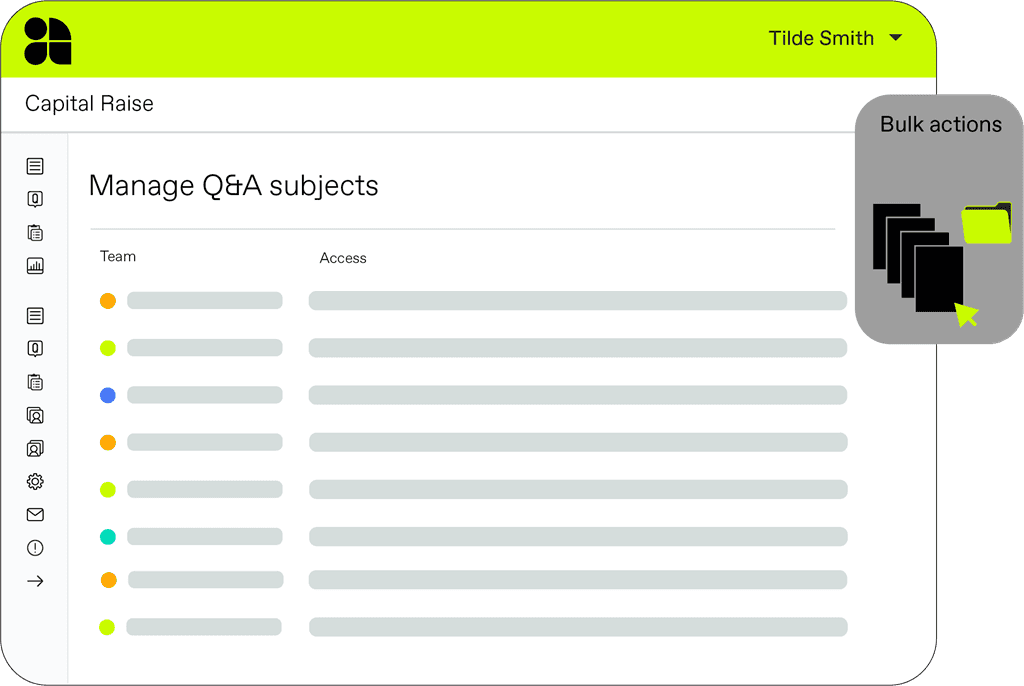

What happens during Q&A?

During M&A, once your data room is up and running, your ability to keep the deal running smoothly will largely revolve around due diligence Q&A. Q&A (questions & answers) is where interested buying parties ask the seller and their advisors a number of questions to decide on the value and attractiveness of the company to be sold. Questions typically relate to documents that have been made available for review through the data room. Answers are often drafted by advisors or subject matter experts in the business and then sent to senior managers for approval. Given the sensitive nature of questions subjects, like HR employment agreements, it is essential that access to subjects can be restricted to both buy and sell side users. Allowing bidders to upload questions in bulk from excel templates and export too is another essential feature in modern Q&A workflow for deals.

What's the best way to manage Q&A?

Some people choose to run Q&A outside the data room using complex Excel spreadsheets passed back and forth over email. On each buy-side team, long lists of questions are compiled and sent to someone on the sell-side. That person then has to review the list and send out clusters of questions to different people in their team to review and respond to. When they receive answers bit by bit from different people they have to continually update their spreadsheet and forward the relevant answers to the relevant buyers. If this sounds like a chore, then you would be right! It’s the single, most time-consuming part of the M&A process. This is where ‘M&A’ can equal ‘Misery & Angst’!

This method is complex, laborious and risky, with question and answers often getting duplicated. There’s the continual risk of sending the wrong information to the wrong person, potentially outdated spreadsheets being in circulation and the creation of an understandably complicated audit trail across numerous email accounts. It can be overwhelming.

Thankfully there is a better way. With all Q&A-related documents being held within the data room, it makes sense to run Q&A here as well. Ansarada offer a Q&A process designed exclusively for M&A to help centralise Q&A workflow and make life easier and safer on both sides of the deal.

What should I look out for when choosing a Data Room for M&A?

Access

- Can you easily connect your data room to drag & drop or automatically import documents from other systems and Cloud storage solutions?

- Will documents imported from Cloud storage solutions automatically sync for constant updating?

- How easy is it to open and view documents?

- Do you need to download any sort of viewing software?

- Can you and your potential bidders access the data room from all operating systems and devices with the same ease or are there any restrictions/caveats?

- How fast and easy it is to change access by user or user group if needed?

Flexibility

- Can you change who sees what, or do blanket security settings apply?

- Do you have flexibility on watermarking, document access, printing, saving, revoking access by user?

- Is the system easily scalable to suit any size deal?

Ease of use

- How fast and easy is it to get the data room up and running?

- How easy will it really be for multiple users to log in from different time zones and operating systems?

- How intuitive is the system to navigate around?

- What systems are in place to help save time, such as bulk upload and download?

- Does the Room come pre-provisioned with workflows and processes?

Control

- How much control can the data room offer over workflow?

- How easy is it to get a clear overview of all activity within the data room?

Search

- How sophisticated is the search facility?

- Can you search within documents as well as across headlines?

- Can you search for terms within PDFs as well as Microsoft Office documents?

Reporting

- What reporting tools are available?

- What format will reports come in?

- Does the Room use AI to automatically predict outcomes and score activity?

- Are easy-to-view and use dashboards included?

- Does the Data Room feature scorecards that automatically show you how your transaction is progressing and the status of documents?

Q&A for M&A

- How easy would it be to run Q&A through the data room?

- Can you easily create scorecards and templates for the transaction?

- Will you still need to use email and spreadsheets for tracking and Q&A?

- Can you easily assign people to review documents, Q&A and information?

- Does the Data Room offer threaded commenting?

Support

- Does the data room offer 24/7/365 support if needed?

- Where is the support based geographically?

- What kind of support is available – just technical, or is more strategic expert support available?

- How fast will they respond to your enquiries? In what format?

Pricing

- How is the cost of your data room calculated?

- Are there any additional fees that could potentially be added as the project moves forward?

- What happens if your deal gets delayed or even cancelled?

- What happens if you exceed information limits?

- What happens if you need to scale-up or scale-down users?

- Can you get access to monthly pricing?

Security

- What independent security accreditation does the provider have?

- What other security measures are in place to keep data from falling into the wrong hands?

- How foolproof is the audit trail?

Experience

- What experience does your provider have in the M&A space?

- Have they ever worked on a deal like yours before?

How to choose a virtual data room

A simple guide to selecting, buying and running a virtual data room.

Choosing a VDR: Advisor checklist

Here’s what advisors need to look for when selecting a virtual data room:

Is there 24/7 support and easy online training?

Ansarada’s detailed and regularly updated Help Centre and onboarding provide essential information — and if you get stuck, our team is available 24/7 to help solve issues for first-timers or experienced deal makers.

Will you be charged for data volume?

Data is critical to help you secure an optimal outcome — it’s not something you should pay for, though many VDR’s charge by data volume. Focus on outcomes and avoid pricing surprises with Ansarada.

Can you access flexible pricing and a scalable VDR?

Due diligence and transaction processes can change quickly. Don’t be locked into an expensive VDR plan. With Ansarada you can pay for as little as one month, or benefit from significant discounts by choosing an annual plan, with unlimited guest users and the ability to introduce extra features when you need them.

Is the security certified and up-to-date?

While legacy data room vendors quote a range of standard security features, only the ‘Statement of Applicability ’ shows compliance with ISO 27001.

Features that ensure critical security are essential too. Look for:

- Granular control of document access

- Ability to track and report on usage

- Ability to destroy downloaded documents in native format like Excel

- Easy to understand and use security functionality

- Are there built-in automations for core tasks?

Basic functionality doesn’t serve the efficiency required for modern dealmaking. More than 70% of deal time is spent on Q&A, so an advanced data room designed to streamline the process can make all the difference. Look for integration with Excel for easy importing of pre-written questions, export of reporting, proof of disclosure and compliance.

38% of all actions in the Q&A process involve getting answers reviewed and approved before disclosure and 90% of all questions take up to six interactions to answer. Streamline Q&A steps with answering and approving answers via email — the easiest way to engage with senior executives.

Comply with procurement policies and recommendations

Ensure that you make a fair and independent recommendation to your client, and don’t be sucked into vendor incentives from legacy data room providers that may not meet many current procurement and compliance policies.

Choosing a VDR: Company checklist

Here’s what to look for when comparing quotes for VDR services:

Ask about pricing the likelihood of cost overruns

Predictable pricing based on a monthly or annual subscription reduces risks and makes space to grow the VDR as your need and the opportunity grow.

Ask about purpose-built tools to streamline processes

The sooner you can get started in the VDR the better. Look for integrations and Cloud connections that enable collaboration.

Are there workflows and AI functionality to speed things up, accurately?

Ask about standardized workflows, AI reporting and functionality, and risk management features that ultimately reduce costs.

How is compliance and probity guaranteed?

Most VDRs offer security, but you want ISO27001 compliance, confirmed with a statement of applicability, to ensure the comprehensiveness of security controls.

Is reporting based on subjective data or real engagement?

AI-powered data insights can predict the outcome of a material event with 97% probability by day 7 of the deal. This enables you and your advisors to focus on the right opportunities and eliminate disengaged bidders.

Does the vendor receive incentives for the VDR?

Data room vendors offer a range of incentives to recommend particular solutions, from sporting tickets to other benefits. Ansarada operates to strict procurement and professional standards to ensure integrity and align with ethical procurement policies.