May 19 2025 |

Mergers and acquisitions are often high-value, high stakes transactions with a lot on the line, so naturally, the M&A process is going to be intensive. The process will vary depending on the size, complexity, and type of M&A deal , but the following steps will be relevant to both buy-side and sell-side teams.

Overview of the M&A process

Broadly speaking, the steps involved in an M&A transaction are:

- Preliminary discussions and non-disclosure agreements

- Assessment and evaluation of target

- Due diligence in a Data Room

- Signing the contract and closing the deal

- Post deal integration

Transform your M&A experience with Ansarada Deals—start for free today !

The 5-step mergers and acquisitions process

1. Preliminary discussions and non-disclosure agreements

The first step in the M&A process is usually high-level discussions between potential buyers and sellers. This is an exploratory stage where companies have the chance to discuss how they might fit together, whether they are aligned on values, and what synergies could be realized by uniting. Before moving forward with the sharing of more sensitive information, it’s best practice for non-disclosure agreements to be executed to ensure prospective buyers aren’t able to use this confidential information for private gain. Learn more about this step in our Modern Deal Series: Marketing .

2. Assessment and evaluation of target

In an M&A deal, the deal team needs to identify and assess all material risks and issues an interested buyer might find during the sale process, or alternatively, evaluate all these risks in the target company if they are on the buy-side. The deal team’s first step is to prepare an assessment of the market. If buyers are unfamiliar with the market, they need help understanding the business and its position in the market. Secondly, they need to undertake a strategic assessment of the business. They must be able to present a convincing management plan to potential buyers on how critical business objectives will be achieved. Thirdly, the deal team must ensure there are audited historic financial reports available for examination by the potential buyers. Buyers will want to see financial forecasts along with past and future financial models in order to provide a valuation of the target company. The deal team will also need to get together an information memorandum: a detailed document on the business that summarizes the company’s financial and business position along with its key selling messages. Learn more about this step in our Modern Deal Series: Preparation .

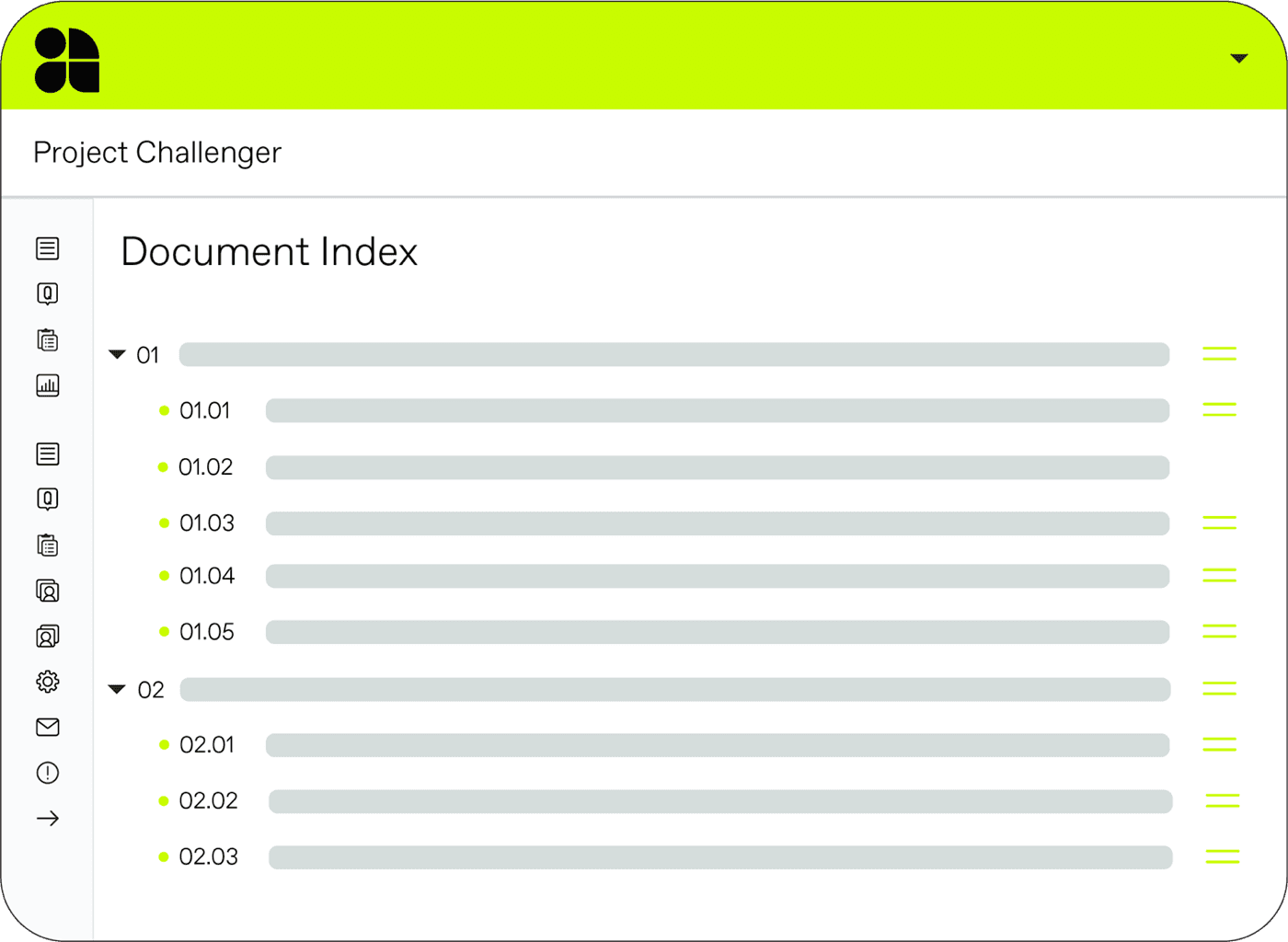

3. Due diligence within a Data Room

Due diligence is a critical point in the M&A process. Data rooms are where companies, their advisors, their potential bidders (and their advisors) can access documents securely and safely, via the internet, from anywhere in the world. A virtual data room is the safest way for companies and deal teams to securely manage deal documents and other important company information. It enables buy-side teams to carefully go through and review and verify all this documentation in a structured and controlled manner. Due diligence Q&A is a significant aspect of this stage, providing a crucial opportunity for all questions to be answered and issues to be resolved within the data room before moving ahead with the deal. Learn more about this step in our Modern Deals Series: Due Diligence .

4. Signing the contract and closing the deal

Provided that there are no unwelcome surprises in the due diligence phase, the two companies will sign the final contracts and finalize the transaction. There may be a pre-closing period between signing and closing, where final actions are taken to satisfy all closing conditions. Once all these conditions have been met, funds are exchanged to mark the official closing of the deal. Learn more about this step in our Modern Deal Series: Closing .

5. Post deal integration

Once the deal is closed, the full-scale integration of the acquired company can begin. This is the final step in the M&A process. As this can be equally intensive to the execution of the transaction itself, it is important that the post-deal integration strategy is developed early and considered alongside the due diligence process . Learn more about post-integration strategies here

Buy-side M&A process

While the steps will remain the same across buy-side and sell-side teams, the buy-side M&A process will focus on carefully assessing the health of the target company, and looking for any gaps in their material information that could impact the deal.

Sell-side M&A process

The sell-side M&A process will focus on providing detailed, up-to-date and accurate documentation regarding all areas of their business. This is to ensure they will receive the maximum valuation for their company when it sells.

Who are the key players in an M&A transaction?

Potential buyers require an extensive list of documents as they conduct due diligence, some of which take significant time to pull together. It’s important for the sell-side to form an internal deal team which can gather all the necessary information any potential acquirer of the company needs. The internal deal team for a small and medium sized business may be no more than 6 people, usually from the finance team and 1 or 2 critical operating areas. This team will work closely with external advisors to ensure a successful deal. These advisors tend to fall in one of the three roles outlined below, although depending on the deal size and industry, it is not uncommon for additional specialist advisors to be required – for example, an environmental advisor that assesses environmental risks, or a property advisor who values properties and forecasts rental costs.

Bankers:

M&A bankers typically work at investment banks or boutique advisory firms that specialize in advising companies on their acquisition or sales strategy. Their role is to identify potential buyers, advise on key value drivers and the valuation of the business, develop an overall M&A project plan (including a detailed timeline for the transaction), and communicate these with bidders. They also play a key role in facilitating and administering the Q&A process with bidders, as well as in negotiations – especially during the terms of the deal.

Lawyers:

Lawyers play an important role in any M&A transaction. Like bankers, they also have an intimate involvement in helping to structure and advise on the deal. They will likely be involved in reviewing and analyzing documents , drafting agreements, and providing some limited advice on terms. They could also be involved giving tactical legal advice as well as conducting legal due diligence and negotiating on behalf of the sell-side company.

Accountants:

Accountants, naturally, will be focused on the financials. They’ll be responsible for signing off on the historical financials to verify they fairly reflect the true activities of the business. They’ll also advise on the most appropriate transaction structure from a taxation perspective, and potentially prepare a summary report on the company’s financials. Learn more: financial due diligence .

How long do mergers and acquisitions take to prepare?

The minimum preparation period for an M&A transaction is 2 to 3 months if there are no substantial changes to the sell-side business or its reporting structure. If there are changes, both internal and external advisors may need 6 months or longer for deal preparation.

M&A process timeline

Ansarada’s historical data shows the average M&A process timeline is generally 9 months or more. However, some of the biggest M&A deals in recent years have taken years to complete. Find out more: Mergers and Acquisitions Examples: Biggest Successes & Failures .

FAQ

What is the M&A lifecycle?

The M&A lifecycle refers to the 5 phases of the M&A process:

- Preliminary discussions and non-disclosure agreements

- Assessment and evaluation of target

- Due diligence in a Data Room

- Signing the contract and closing the deal

- Post deal integration

How long do acquisitions take after announcement?

Acquisitions can take anything from a few months to several years, depending on the complexity and size of the deal.