Get your raise in order with our capital raise checklist

Capital raising, done right.

Understand capital raise checklists and how to use them

Learn how to structure your information to avoid unnecessary time, cost and risk

Use the free digitized capital raise checklist template inside your Data Room

Automate your capital raise workflow and close the deal faster

Make it easier on yourself with the capital raise checklist

What is a capital raise checklist?

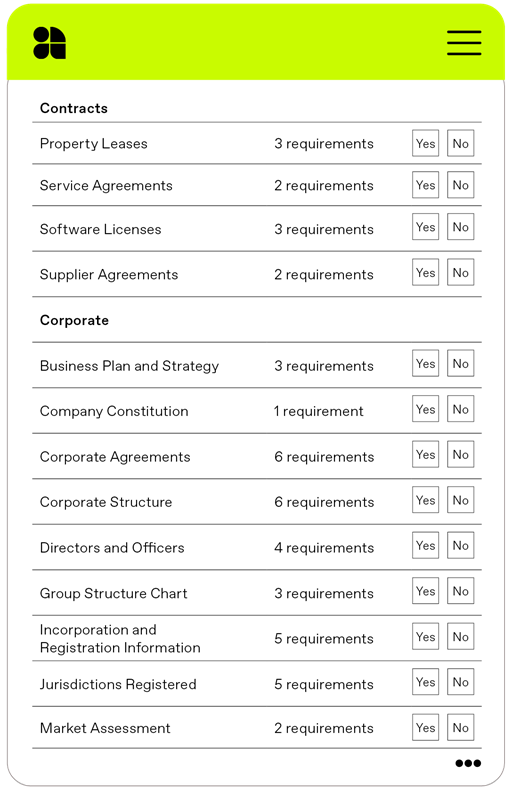

A capital raise checklist is a is a type of due diligence checklist used by those who are preparing to raise capital for their business. It is a checklist of all the documents that need to be collated, verified, and reviewed as part of the due diligence phase that takes place when raising capital.

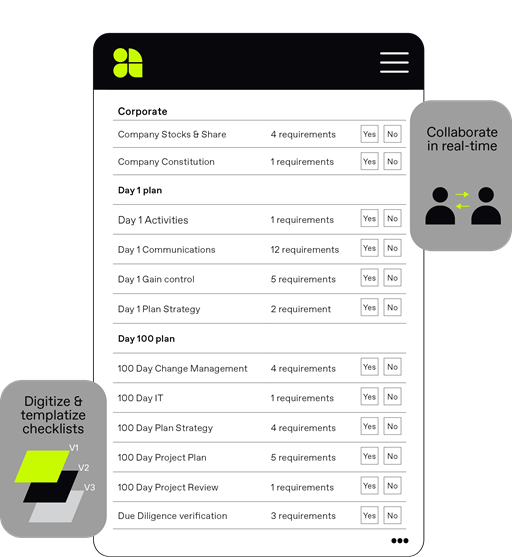

While due diligence checklists are often created as Excel spreadsheets or Word documents, modern dealmakers are increasingly turning to data rooms that can digitize these checklists to facilitate due diligence without the risks associated with legacy tools, such as version control issues and human error.

47% of deals fail due to issues that are surfaced during the due diligence process. Uncover these early and be ready to seize opportunity.

Raising capital in an uncertain market

Capital is essential for running any business, but the current climate has created additional urgency. Debt and/or equity raising are solutions for helping companies to survive and thrive – but being disorganized and unprepared equates to unnecessary risk.

In a fast-paced and uncertain market, companies and their advisors need to be ready to act. Being able to quickly convert debt or equity into capital is what will enable them to grow the business, weather disruption and realize their potential.

Whether you are raising capital by borrowing funds or selling shares to investors, a lot of disclosure needs to occur. That equates to a lot of risk. Especially if information is being prepared and shared using insecure legacy systems like spreadsheets and emails.

Investors ask questions; you need to have the answers. The process takes an average of 9 months, which is a huge amount of work and cost when you are running your business at the same time - even more so in an uncertain market.

Common capital raising challenges

- Not knowing what you’ll find in your critical business information before facing scrutiny from investors

- Not knowing what investors are looking for - what does ‘good’ look like?

- Being unprepared for the volume of preparation for your raise, which can impact BAU

- Having this disorganization reflect poorly on the company

- Struggling to collate information and feedback across disparate systems

- An overall lack of confidence in the process

The key to generating momentum is order. Organizations that are organized are able to raise faster. The longer the process, the riskier it becomes.

Capital raising best practices

The five momentum makers below are the key to best practice when it comes to getting your raise in order.

1. KNOW

Step one is knowing your business inside and out, and all the critical information it comprises. Without a full knowledge of your own business and its DNA, how will you stand up to scrutiny from third parties?

2. PREPARE

Better equipped, better prepared. The more confidence you have in your structured information, the more you will impress investors.

Prepare early using purpose-built tools for the job, and avoid legacy tools like spreadsheets and emails.

3. CONNECT

Build relationships. Give updates and get feedback from investors; they have great advice to give and are often more than willing to help. Connect with great legal and financial advisors so you can develop understanding early on in the process.

Talk with your team. Internal relationships are just as important. They’ll be the ones running the business while you are busy with the raise.

4. ASK

Ask all the questions. Ask investors for exactly what you need and when you need it, ask for your preferred structure and terms, and ask for feedback; find out how well aligned you are with investors, and discuss it openly with them.

5. PROVE

Be certain. Be in control. Prove you are a person who takes action and has the evidence to back it up. Prove you can be trusted and have the foundations in place that investors can safely build on with you. Prove that you are entirely organized throughout this process, which reflects back on the business as a whole.

Bring order to your raise and increase business value

Since 2005, we’ve accumulated more than a decade’s experience on over 35,000+ critical business transactions and learned exactly what good looks like. We know exactly what investors will be looking at and scoring you on.

Our Capital Raise (Debt & Equity) checklist takes all these insights and gives you a clear framework to follow to get your raise in order.

We’ve made access to the Ansarada Deals platform for companies completely free, so you can open a free Data Room and get started on your raise in minutes with no risk and no cost.

Say no to risky, insecure processes and get your raise in order. Start preparing today for free using your purpose-built capital raise checklist alongside your Data Room.