Insurance and wealth drive ANZ’s finance M&A boom amid tech transformation push

ANZ is leading global finance and banking M&A activity with 92% year-on-year growth, driven by strategic consolidation in insurance and wealth management sectors, technology-focused acquisitions, and strong private equity interest despite short-term market volatility.

By AnsaradaTue Jun 10 2025Mergers and acquisitions, Advisors, Industry news and trends

The Australia and New Zealand (ANZ) region has emerged as a standout performer in the global finance and banking M&A landscape, demonstrating remarkable resilience amid widespread market uncertainty.

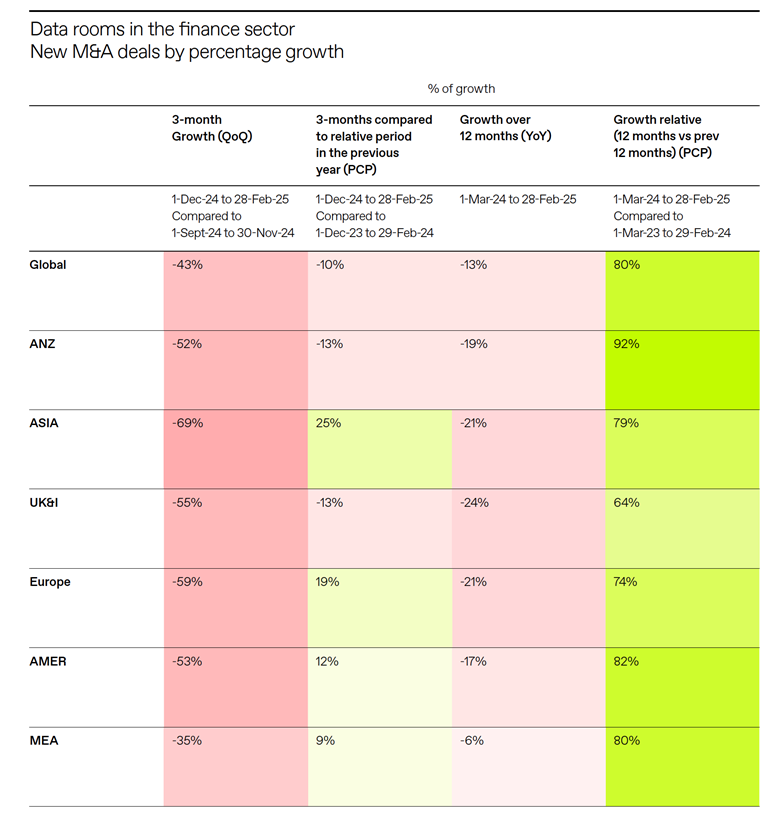

According to our latest Ansarada Deal Room data shared in the 2025 Global Finance & Banking M&A Outlook Report, ANZ achieved an impressive 92% growth in deal room activity over the past 12 months, significantly outpacing other major regions including the Americas (82%) and Middle East and Africa (80%).

This performance positions ANZ as the most promising region globally, despite experiencing a quarterly decline of 52% in deal room activity from December 2024 to February 2025. The region's ability to maintain momentum reflects both market maturity and strategic positioning for long-term growth.

Market dynamics and key drivers

Our report found that the ANZ financial services sector is experiencing significant consolidation, with the Hayne Royal Commission's ongoing influence creating a unique market dynamic. "After a number of significant non-core disposals from the larger Australian banks in the last five years, particularly after the Hayne Royal Commission in 2017, we have not seen as many large transactions in the Australian financial institutions market in the last few years," explains Hannah Hesse, Partner, Deal Advisory Tax at KPMG Australia. "However, given the constrained economic environment in 2023 and 2024, valuations were challenged, and regulatory issues have meant that some transactions have been slow to close."

This regulatory backdrop has resulted in selective activity, with the merger between Auswide Bank and MyState Bank representing the only notable public banking transaction over the past 12 months. Keith Tan, Special Counsel and Alberto Colla, Partner at MinterEllison, observe: "This reflects the ongoing consolidation within the Australian banking sector during uncertain times. This consolidation trend is driven by the need for scale, technological investment, and regulatory compliance."

While transaction volumes have been modest, the deals that have proceeded show a clear strategic focus. Banks and insurance companies have pursued smaller, technology-driven acquisitions as digital transformation becomes paramount. "While 'fintech' fundraising and deal activity has declined in the last 24 months, payments businesses have been a particularly popular target – showing how the attractiveness of technology and software companies is changing the shape of traditional financial services," Hannah adds.

This shift reflects institutions' careful cost-benefit analysis between acquiring capabilities versus building them internally, particularly for cloud banking APIs and geographic expansion opportunities.

Sector-specific insights

Insurance sector leadership

The insurance sector has been particularly active, accounting for a significant portion of announced deal activity since January 2024. Insurance broking consolidation has attracted both local and international players pursuing roll-up strategies, while Auto Club Insurance activity has seen notable transactions like Allianz's partnership with RAA and IAG's purchase of RACQ's general insurance activities.

Richard Long, Principal, Corporate Finance Advisory at Deloitte Australia, notes that insurance and wealth have been driving forces: "Sub-sector transaction trends have varied widely, with Insurance (both broking and underwriting) and Wealth accounting for 72% of announced deal activity since January 2024." The synergies and value arbitrage opportunities given prevailing PE ratios are driving market consolidation across the sector.

Wealth management expansion

The wealth sector has represented approximately 45% of financial services sector deal activity across asset management, advice and services sub-sectors. This growth is fueled by private credit's emergence as a growing asset class, with deals like HMC Capital acquiring Payton Capital demonstrating the trend.

"The wave of Australians approaching retirement is fueling demand for advice and we expect major Australian banks – having divested from wealth in years past – to seek to selectively re-enter and capitalize on this growing demand," Richard explains. This demographic shift is creating sustained opportunities for strategic acquisitions and partnerships in the wealth management space.

Non-bank lending recovery

After facing challenges from rising funding costs and credit risk concerns, the non-bank lending sector is showing renewed activity in the second half of 2024. Pacific Equity Partners' acquisition of SG Fleet Limited highlights this recovery, as institutions adapt to changing market conditions and seek operational resilience.

Regional investment flows and international interest

International investment patterns are shifting significantly, as Richard Long observes: "While cross-border M&A inflows have historically been skewed toward North America, we are seeing a growing volume of Japanese inbound interest – a trend we expect to continue." This pivot reflects Japanese companies' strategic pursuit of stable, high-quality opportunities in aligned markets.

Simultaneously, private equity and private credit funds are demonstrating unprecedented appetite for Australian financial services assets. Technology-led wealth platforms and payment companies remain attractive targets, while auto finance and leasing businesses continue to see strong interest. Roll-up opportunities in insurance brokerage and wealth advice sectors are particularly compelling, with private credit solutions providing efficient capital in the non-bank sector.

Hannah Hesse highlights this fundamental shift: "Both Australian and global funds are continuing to look at Australian financial institutions – while this has not historically been a significant focus area for private equity, this is becoming an increasingly attractive investment pillar.”

Regulatory environment and outlook

The Australian Securities and Investments Commission (ACCC) has highlighted key concerns regarding private credit markets, emphasizing fund governance and valuation practices, conflict of interest management, fair treatment of investors, and enhanced transparency requirements.

Alberto Colla and Keith Tan highlight the competitive scrutiny ahead: "As our larger banking and financial institutions have already undergone a period of consolidation, they now exhibit a significant concentration of market power. Therefore, deals in this space will attract close scrutiny from our competition regulator even before the upcoming ACCC reforms are implemented."

Given the concentration of market power among larger banking and financial institutions, future deals will face close scrutiny from competition regulators, particularly with upcoming ACCC reforms creating additional oversight layers.

2025 outlook and predictions

Recent global volatility and trade tensions represent immediate risks that may stall or delay transaction processes in the short term. The observed decline in active M&A data rooms points to potentially slower deal announcements through late 2025 and early 2026.

However, several factors support continued M&A momentum despite near-term headwinds. The normalization of deal timelines as extended due diligence processes become more competitive, interest rate moderation improving financing conditions, technology integration needs driving strategic combinations, and market stability following the completion of major political cycles all contribute to a positive longer-term outlook.

Hannah Hesse remains optimistic about the trajectory: "Notwithstanding some of the more recent turbulence, we are expecting an uplift in financial institutions M&A activity in 2025. More broadly in the Australian market, we are seeing heightened deal activity across sectors, early signs of a re-opening of the IPO market after a number of quiet years and with the election completed, a more stable Australian political environment."

Conclusion

The ANZ region's exceptional 92% year-on-year growth in deal room activity, despite global headwinds, demonstrates the market's underlying strength and strategic positioning. While short-term volatility may create temporary challenges, the fundamental drivers of consolidation, technological transformation, and regulatory compliance continue to support a robust M&A environment.

Financial institutions in ANZ are well-positioned to capitalize on emerging opportunities, particularly in technology-enabled services, wealth management, and strategic consolidation plays. With normalized deal processes and improving economic conditions expected, 2025 looks set to be a pivotal year for finance and banking M&A in the region.

As Richard Long concludes: "The glass-half-full interpretation of the fall-off in data room volumes is the emerging normalization of deal timelines. The last few years have been challenged by extended transaction timelines as Buyers taking a more measured approach to transactions and conduct extended diligence. This appears to be normalizing with processes becoming more competitive."