.jpeg?width=1000)

Make sense of the market with Ansarada’s new data report

Get the insights from FY23 Global Deal Indicators

The Deal Indicators report was created to help our customers benefit from the wealth of data we collect anonymously through our data rooms and platform.

We’ve taken tens of thousands of raw, anonymized data points from more than 24,000 deals - including those that are active and ongoing – and ordered them to surface emerging trends across deal types and industries.

Most data reports are written after the fact. They tell you what’s already happened, giving you a picture of ‘what was’ and offering little value.

Indicators gives us a unique ability to show you the trends six to twelve months before the rest of the market, the average deal taking that long to complete.

Get full access to the data

Future-proofing with M&A: 'Pause' won't last long

Buyers seek tech, talent and sustainability

Investors prioritize green over growth

The predicted wave of insolvencies is finally here

IPO bankers play the waiting game

The dearth of IPO activity we have felt in the first two quarters of 2022 is clearly supported by the Q4 FY22 Indicators Data. In the first two quarters of 2022 we have seen IPOs that commenced in 2021 and that had hoped to come to market in early 2022 being put on ice, as well as new IPO processes that were expected to commence in early 2022, delaying commencing any process now and instead indicating a ‘re-look’ towards the end of 2022."Patricia Paton, Partner, Hamilton Locke

Trends happening inside the Data Room

![Data room behaviour]() Data room behaviour

Data room behaviour

What's happening inside the Data Room?

Legal roles by far the busiest

Legal roles were a standout in terms of data room activity, surpassing all other roles by far in terms of room logins in the first half of the year. Data room logins for lawyers peaked in mid-May, with over 12,000 logins in a single day – more than advisory and corporate logins combined.

Corporate finance/advisor roles were the second busiest group during this period, followed closely by corporate roles.

Dealmakers have cut 1.5 months off their deal time

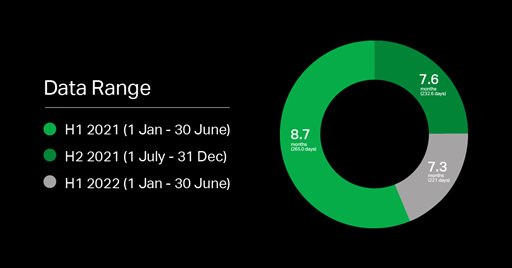

Our Indicators show that the average deal duration has been steadily getting shorter since the first half of 2021. Deals on average are taking 7.3 months to complete, compared to the 8.7 months they took in the first half of 2021.

Similarly, the average number of M&A bidder groups has also reduced in size, going from 6.7 in H1 2021 to 5.3 in H1 2022.

This is empirical confirmation of what we are beginning to see on the ground: increased business distress across the board, but particularly in construction, property and retail. Business needs to prepare for economic headwinds.”Noel McCoy, Partner, Norton Rose Fulbright

Industry spotlight

Tech M&A still on top

The technology, media and telecommunications (TMT) sector continues to grow despite the chaotic market, with our Indicators showing a 35% QoQ increase in new tech M&A deals commencing and a 33% QoQ increase in communication services deals. New Software & Services transactions of all types grew by 26% over the quarter.

Digital transformation and adoption of new technologies remain a key priority for dealmakers, with over a third of deal value in the first half of 2022 attributed to TMT deals, and more than a quarter of all deal volume (PwC).

Building digital infrastructure

This transition to digital - spurred on by the pandemic - will require significant digital infrastructure to support it. We’ll continue to see strong technology demand globally, with increased M&A activity in areas like 5G and IoT, fiber networks, WiFi towers and data centers.

These types of information facilities will be critical to rolling out new technologies, managing growing data requirements, and keeping communities connected.

The increasing reliance on digital services and the rapid growth of the cloud computing industry has led to the demand for more data center capacity. According to Synergy Research, 87 data center M&A deals were completed In the first half of 2022. With more set to close this year, the boom shows no signs of slowing.

Diving market valuations drive early exits

It’s not all smooth sailing for tech companies, however. Market valuations have come down considerably, making access to growth capital more challenging. The median value raised by tech startups in Series A funding rounds declined by 14% QoQ in the January-March quarter of this year (Carta).

In the absence of liquidity and accessible funding, we can expect to see more early-stage startups taking the exit route. And with the IPO market on pause, large-scale private companies are opting to acquire these startups. VC-backed companies have already acquired 663 VC-backed startups in 2022 so far (Crunchbase).

Energy, utilities, materials & industrials focus on ESG improvement

New energy M&A deals commencing dropped by 14% QoQ globally and decreased by 4% YoY.

Similarly, new industrials M&A deals commencing decreased by 22% QoQ. Oil and gas in particular has been hit hard by supply pressures as a result of the Russia-Ukraine conflict and the subsequent volatility in global markets.

However, there was growth in the materials and utilities sectors, with a 12% and 6% QoQ increase respectively.

It’s anticipated that ESG will be the main driver of M&A in the energy, utilities, industrials and materials sectors as the clean energy transition continues to take shape.

Growing numbers of major global banks, asset managers and insurers are joining the Glasgow Financial Alliance for Net Zero (GFANZ) to align on the Paris Agreement treaty, meaning that companies must meet stringent climate criteria to access capital. Some banks have chosen to abandon oil and gas companies entirely.

Climate criteria will increasingly determine which deals are allowed to move forward; environmentally-friendly projects that support global sustainability goals will ultimately come out on top. ESG considerations will be a focal point for due diligence in these deals.

A handful of clean commodities drive mining M&A

Demand for a very specific selection of commodities will keep mining M&A active in 2022 and beyond. The transition to net-zero will rely heavily on the supply of minerals and metals like copper, nickel and lithium, which will require metals and mining companies to grow faster - and cleaner - than ever before.

Depending on the transition scenario, copper demand could exceed supply by 5 to 8 million metric tons and nickel by 700,000 to 1 million metric tons by 2030. That means for just these two hot commodities, meeting demand growth could require $250 to $350 billion capital expenditure to grow current capacity, according to McKinsey.

Opportunities to acquire assets with access to commodities like these will be especially attractive.

Big Rebound from Big Pharma expected in the second half of 2022

New healthcare M&A deals commencing decreased by 16% QoQ, but increased by 1% over the financial year. While the numbers indicate a growth slowdown in the first quarter, experts anticipate a strong rebound in the sector in the second half of 2022, driven by the life sciences and pharmaceutical industry. Our Indicators show us that Pharmaceuticals, Biotechnology & Life Sciences deals increased by 44% QoQ, and 25% YoY globally.

In their mid-year outlook, PwC says that the stars are aligned for major activity across the sector, even despite the slow start. The combination of cashed-up pharma players, normalizing biotech valuations, and the approaching 2025 patent cliff is likely to create a flurry of activity. Demand also remains high for biotechs and emerging health technologies like mRNA and telehealth, which have flourished since the early days of the pandemic, making these companies particularly attractive to investors.

2025 will bring fresh competition to pharma players

Referred to as the ‘patent cliff’, big pharma companies and investors are preparing for 2025, which will see a number of major players in Europe and the US lose market exclusivity. Faced with competition for the first time, we can expect to see more of these players turning to M&A strategies to consolidate, diversify and grow over the next 3 years to keep their pipelines full. Higher volumes of smaller transactions are anticipated as companies seek to avoid the minefield of regulatory requirements that are typical of larger, more complex transactions.

New regulatory hurdles could set California healthcare deals back

Meanwhile in California, a new bill threatens to pose new regulatory hurdles for healthcare deals. The Health Care Consolidation and Contracting Fairness Act of 2022 will require the Attorney General to ‘approve, deny, or conditionally approve all transactions involving for-profit medical groups, health systems, pharmacy benefit managers, health plans, health insurers and hospitals, where the value of such transaction exceeds $15 million’ (National Law Review).