May 19 2025 |

What is liquidation in business?

Liquidation, also sometimes referred to as "winding up" a company, is when a company's assets are liquidated (sold) and the company closed or deregistered. It is generally the last resort when it comes to business exits , for owners, and to corporate bankruptcy , for directors.

Companies usually file for liquidation under chapter 7 of the US Bankruptcy Code when there is no chance of profitability via a chapter 11 (reorganization) petition.

Types of business liquidation

There are 3 types of company liquidation:

- Creditors' Voluntary Liquidation – for companies with debts that file a chapter 7 bankruptcy petition.

- Members' Voluntary Liquidation (or simply Voluntary Liquidation) – standard liquidation exit plan for solvent companies with no debts.

- Compulsory or Forced Liquidation – this is a dissolution order issued by a court, usually in response to a petition by creditors.

Learn more: Types of Liquidation of a Company

Small business liquidation process

Depending on the type of liquidation required, the process for small business owners will be slightly different. For example, if you’re opting to close down a solvent business and liquidate assets in a voluntary liquidation, you will need to:

- Agree to close the business (in writing): Sole proprietors can decide on their own, but any type of partnership requires co-owners to agree.

- Create an inventory of business assets: Assets can include furniture, equipment and merchandise.

- Dispose of assets: Consider holding a liquidation auction .

- File business dissolution documents.

- Cancel registrations, licenses, leases, permits, and trade names.

- Pay employees in compliance with the Department of Labor’s Worker Adjustment and Retraining Notification Act (WARN).

- Pay debts and handle final tax returns for income tax and sales tax

- Follow this checklist from the IRS .

Remember to keep all records. It’s usually advised to keep them for between three and seven years.

For small businesses in financial distress and creditors to pay, however, the process will be dictated by the US Bankruptcy Code.

What happens to directors when a company is liquidated?

Under Chapter 7 of the US Bankruptcy Code, the company being liquidated is put out of business and therefore its directors are out of a job. As company shareholders, directors are last in line to be paid as creditors.

What happens to shareholders?

Shareholders take the greatest amount of risk in the success or failure of a company. They will not be able to recover any assets in a corporate bankruptcy situation if other creditors’ claims are not fully repaid.

How Ansarada can help

Every day we help thousands of businesses get ready for and experience success in M&A, re-financing, restructuring, post-acquisition integration, liquidation and more.

Trusted by professionals

With over fifteen years of experience on 24,000+ critical deals and over $1 trillion in deal value transacted on our platform, your bankruptcy preparation, liquidation or restructure couldn’t be in safer hands.

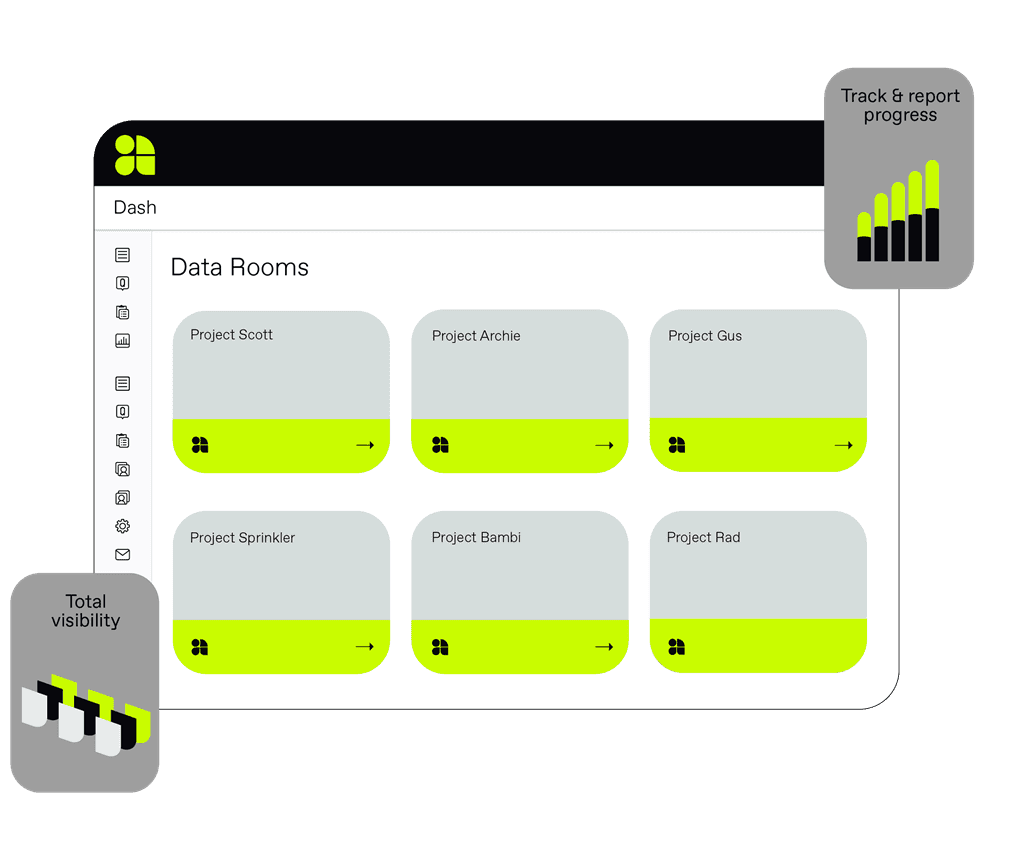

Secure collaboration & data sharing

Collaborate with creditors, Directors, advisors, and other interested parties using clear and up-to-date information, with no dispute or confusion as to data sources. Remove the stress and uncertainty of spreadsheets; exits are stressful enough.

Liquidation exit planning

Make sure your business is future-ready. Use Ansarada’s Workflow tool to get total oversight of threats, risks, and gaps. Understand your next steps, feel guided, and reassured. Workflow features are completely free to use.

Rapid bankruptcy facilitation

Initiate your chapter 7 bankruptcy proceedings with clarity and confidence. Ansarada facilitates insolvency and bankruptcy proceedings with the world’s most advanced Virtual Data Rooms, bank grade security, Q&A features and streamlined Workflows.