May 19 2025 |

Smart businesses will already have started planning for a recession . Here, we investigate some different strategies for business survival during a recession and whether it’s possible to make your business “recession-proof”.

There’s some specific advice for entrepreneurs at the end, as well as examples of what big businesses do to survive recessions. There’s also plenty more information you can access in our Recession Readiness Hub .

Can businesses be successful during a recession?

In a word, yes. There are many businesses that have been started during a recession or have grown during an economic downturn.

Disney was founded at the beginning of the Great Depression in the late 1920s, while Hewlett and Packard began work in the recession that followed in the late 1930s. Netflix, Citigroup, Groupon and Lego are all examples of businesses that thrived during the 2008 Great Recession.

Learn more: How to Grow Your Business During a Recession

Making your business “recession-proof”

Is there such a thing as a recession-proof business? Well, it depends what industry you’re in. There are certainly industries that are more likely to make it out of a recession relatively unscathed. These include groceries/food and beverage, telecommunications, tax and accounting (after all, there are only two certainties in life: death and taxes!)

7 strategies for business survival during a recession

With all that said, it’s wise to assume that no business is safe when it comes to a recession. So here are some strategies for business survival during a recession you can employ to give your business the best chance.

1. Cut or reduce unnecessary costs

This is an obvious one but it’s by no means a silver bullet solution, nor is it sustainable. However, when times turn tough you might want to consider the following:

- Negotiating down your monthly rent and any other supplier costs

- Find cheaper vendors for utilities and cut any non-essential technology costs

- Delay payables and collect receivables sooner

- Consider whether poorly performing employees are worth retaining

- Look at flexible staffing options

2. Protect cash flow

Above all else, ensure you have steady and reliable cash flow. If this means applying for government grants or other assistance, do so. (See point 6.)

3. Nurture your existing customer base

Reach out to your existing clients or customers and ask them what they want or need from you. Listen to them and then deliver outstanding customer service. If your existing customer base is nurtured throughout a difficult time, they are more likely to be loyal and recommend you to their networks. You might even consider cutting the bottom 20% of your worst-performing customer base to ensure you’re devoting precious resources to those that are worth it.

4. Support the employees you’re retaining

A recession naturally provokes anxiety and fear, especially if costs are being cut and employees are being furloughed or even laid off. Letting your poorest-performing employees go may be a step you need to take.

If so, build morale and motivation in the employees you’re retaining by clearly communicating with your staff what is happening within the business. Try to involve them in the decision-making process, so they can feel included and part of the solution. Motivate them to work hard because you’re all in it together.

5. Look for operational efficiencies

What can you automate? What can you streamline? Where’s the bloat within your processes and day to day operations? If you can wheedle it out during a recession, your business has a better chance of survival.

6. Seek available assistance

As at the start of the Covid-19 pandemic, there may be government assistance packages available to businesses like yours. This could mean the difference between having enough cash flow to ride out the storm, or breaking under the weight of a crumbling economy, so whatever’s on offer make sure you take it.

7. Bring it back to what you’re really good at

Every business has a product, service or area in which they really excel. They also have supporting services, markets they’re trying to crack, and new products they want to push. During a recession is usually the time to refocus and bring it back to those core competencies that are tried, tested and true.

How do you succeed as an entrepreneur in tough economic times?

Times of economic recession (and economic growth) bring about opportunities. Entrepreneurs who can quickly adapt to the changing environment will be more successful than others.

Be ready for an opportunity

It’s not all doom and gloom; market disruption can lead to opportunity. If you’re able to see it, you might be able to take advantage of a bad situation. After all, spotting gaps in the market and outside-the-box thinking is an entrepreneur’s jam.

Build relationships

Always keep the lines of communication open. Get out there, network and build relationships. Keep your ears open, your eyes peeled and your thinking outside the box because you’re going to need your wits about you to spot those much-needed opportunities.

Use technology to your advantage

When that golden opportunity comes along, you’ll need to be quick off the mark to capitalize on it, especially in a depressed market. Capital raising can take several months and the best way to accelerate it is to use the latest technology to guide and automate what can be a complex and labor intensive process.

Make it easy on yourself. Download the capital raise checklist now.

How can big businesses survive recessions?

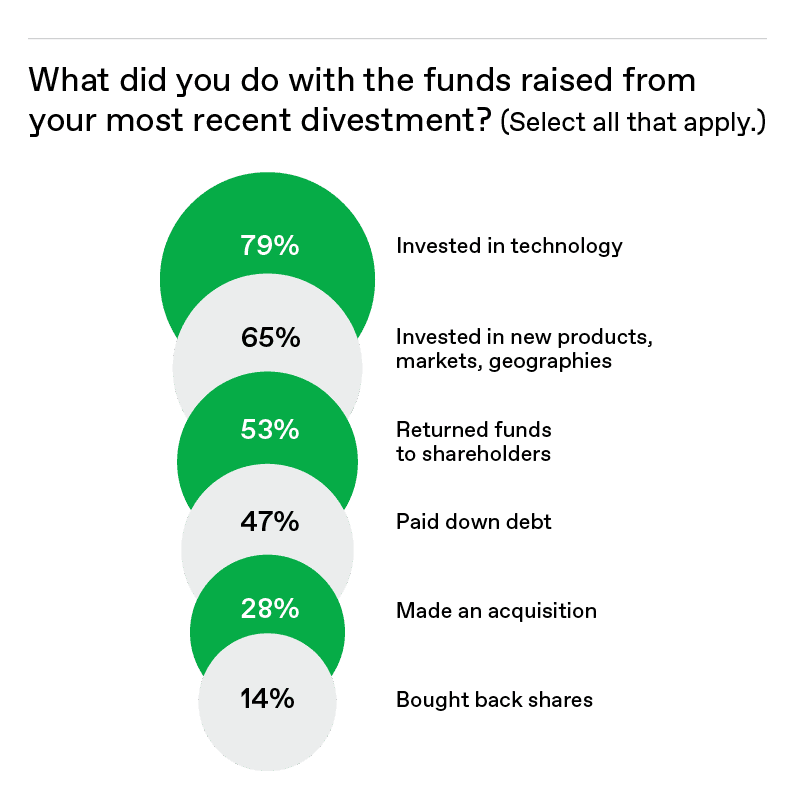

Big businesses survive recessions by determining what’s working (core competencies) and getting rid of non-essentials (divestments). Money raised from these divestments can be reinvested into the business’ highest growth areas, as indicated in the 2021 EY Global Corporate Divestment Study below.

Source: 2021 EY Global Corporate Divestment Study