Streamline your deals with confidence

As the scope of due diligence continues to expand, join Investment Banking firms across the globe confidently tracking outcomes from the outset.

How Investment Bankers are elevating their services

Maximise efficiency:

Focus on high-value tasks like deal strategy and negotiations without being slowed down by administrative or technical issues.

Accelerate deal closures:

Move deals along quickly without unneccesary delays or technical hassles.

Enhance client trust:

Boost credibility and confidence leveraging a professional, worry-free environment to share confidential information.

M&A insights from top Australian dealmakers

Curious about what's driving M&A deal activity in 2024? Our latest ANZ M&A Outlook Report 2024/2025 has the answers you need to seize the opportunities.

Trusted by leading Investment Bankers

“What I like most about Ansarada is the easiness of the solution. It not only benefits myself, but my whole team."Jan Hatje, Partner, Oaklins Germany

Maximise efficiency

Managing complex deals requires complete focus on strategy, not on operational hurdles. Our virtual data room introduces order and simplicity into the document management process, so you can concentrate on what really matters—negotiating and closing deals.

With streamlined workflows and easy access to critical files, our solution minimizes distractions and ensures that your team is working at peak efficiency, turning complex transactions into smooth, seamless processes.

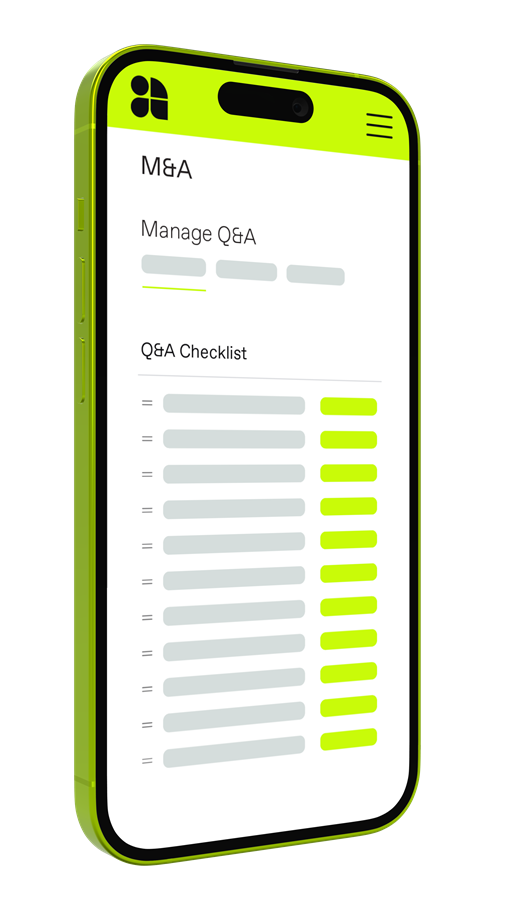

Enhance client trust

Trust is the foundation of every deal, and it starts with secure, seamless data sharing. Our virtual data room gives you the confidence to assure your clients that their sensitive information is fully protected.

With intuitive controls and robust security features, you can offer clients peace of mind while maintaining complete control of the deal process.

This not only strengthens client relationships but ensures that your firm is seen as a trusted partner for future transactions.

Accelerate deal closures

In the high-stakes environment of investment banking, speed is everything. A well-designed virtual data room allows you to focus on driving deals forward, free from the bottlenecks of clunky systems.

With fast, organized access to key documents, your due diligence process is more efficient, ensuring nothing stands in the way of closing a deal quickly.

In a market where every moment counts, our technology ensures you’re always moving at the pace of opportunity.

Get started for free

Investment Banking teams across the globe are delivering secure and efficient services to ther clients and bringing order to their deal chaos with Ansarada.

Now you can get started for free! Ansarada is free to use for the first 90 days, or until your deal goes live, whatever comes first.

Simple, smart, secure

Maximising efficiency and security for Investment Bankers

Error-resistant processes

Keep your process resistant to human error, with all complexities at the backend.

Granular access & permissions

Refine your permission controls down to the user.

Effortless file tracking

Track usage and self destruct files regardless of their saved location.

Experts on call 24/7

Data room software that comes with award winning round-the-clock support and customer success management

Leave a trail

Full audit trail of all activity, including reporting on access setup.

Bullet-proof security

Satisfy risk, compliance and disclosure requirements with ease. Reports capture every action.

Mastering M&A Markets & Moguls

The story of Sean O'Neill, Managing Director at Nash Advisory

Latest news