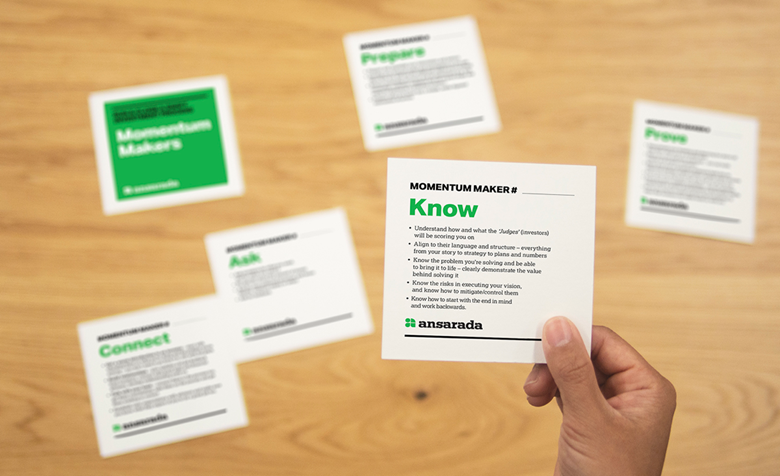

Deal Momentum Makers #1: Know

By ansaradaMon Nov 05 2018Capital raising

If you watched Ansarada CEO, Sam Riley’s recent workshop, then you’ll already be familiar with the term ‘momentum makers’ – or, the keys to running a swift and seamless investment process. Each five contribute to making momentum in a deal. Momentum is critical. It helps close the deal faster; the longer deals run, the riskier they are. In the series of momentum makers, step one is knowing. Knowing your business inside and out, and all the critical information it comprises. Without a full knowledge of your own business and its DNA, how will you stand up to scrutiny from third parties?

To learn more about all the steps to running a swift and successful investment process, access Sam’s full workshop here.

The key features of knowing:

- Understand how and what the investors will be scoring you on. Read our earlier blog here for a comprehensive overview on what the investors (or judges) will be looking at and scoring you on.

- Align to their language and structure. Everything from your story to strategy to plans and numbers need to align and support one another; if even one is unclear, the whole thing becomes unstable.

- Know the problem you’re solving and be able to bring it to life. Be able to clearly demonstrate the value behind solving it.

- Know the risks in executing your vision and know how to mitigate them. Investors think in terms of risk, so don’t shy away from them. Bring them out early; demonstrate that you’ve not only thought about them, but that you have ways of managing them in place. This includes a framework that can identify and measure risk, and attribute your actions back to the metrics.

- Know how to start with the end in mind and work backwards. There’s a reason that a company is in its best shape at the end of a deal. Keep your eye on the ideal future state, and work towards that. When you know what’s possible, you can make it happen.

To learn more about all the steps to running a swift and successful investment process, access Sam’s full workshop here.