Accelerate your targeted acquisitions

Accelerate your targeted acquisitions

Accelerate your targeted acquisitions. Save time with streamlined due diligence for acquirers and buyers. Run a tight process with collaboration tools that are designed for buy side deals.

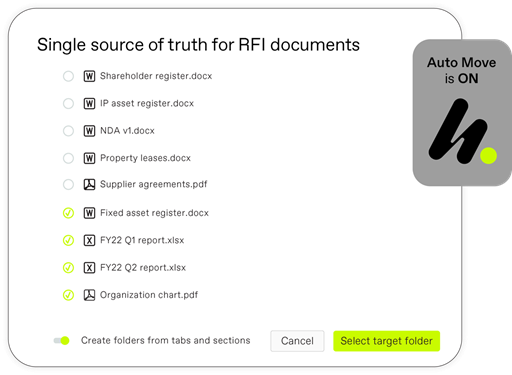

Collect your target's documents in one shared checklist to fast-track collaboration and execution

Speed up the evaluation, acquisition and integration of targets

Move fast, minimize risk and close more high-value deals

Bring order. Acquire faster.

With Ansarada you streamline your acquisition process. Create tasks, assign requests for information and review your target’s documents all in one secure platform.

Prepare

Import your checklist from Excel or use our template.

Collaborate

Invite your target and assign checklist items.

Review

Monitor target activity and document uploads in real time.

Acquire

Keep using your data room for post-acquisition checklists.

Amplify your acquisition process

Get prepared and gain fully visibility over your most promising targets, all in the one location.

Real-time acquisition Workflow

Coordinate activity across your team and target with a shared checklist and real-time collaboration.

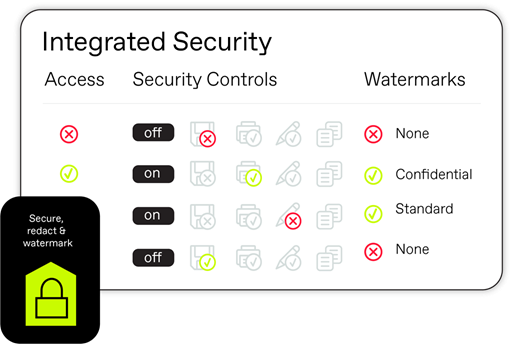

Bank-grade security for every document

Protect sensitive information with bank-grade security in our award-winning Virtual Data Room.

Order shaves days off diligence

Speed up diligence and decision-making with clear structure and visibility.

Stay Always ready for your next acquisition

Continue storing key documents after close and remain 'Always' ready for integration and audit.

“It's hard to imagine life before Ansarada in a lot of ways. All the features & functionality we like about Ansarada didn't exist at the time; we were using 2-3 different VDR providers before ultimately standardizing on Ansarada as a serial acquirer. It’s helped getting that data into the data room down to a science,” John Mills VMWAREJohn Mills, Associate General Counsel and Senior Director of M&A and Investments, VMWARE California