How much is legacy behaviour costing advisors?

Advisors shouldn't waste time & resources approaching new deals with legacy behaviors. Find out how to stop repeating the same ineffective, costly processes.

By ansaradaThu Mar 15 2018Innovation

‘Business as usual’ is no longer usual. As we wrote in a recent article, change is the new norm and there are consequences for staying still.

Advisors are wasting far too much in time and resources every year. Manually pulling and analyzing reports, operating across disconnected systems, and basing critical decisions on instinct instead of fact – then, repeating the same ineffective processes for each new deal.

So how much is legacy behaviour actually costing you? Why has it become so expensive to continue using the same systems and processes you’ve depended on for years?

Here’s why it’s costing more than you think.

1. Legacy systems are inefficient

According to CapGemini, ‘low advisor productivity has been a result of manual operations, non-integration of key processes coupled with technology tools, and capabilities silos.’ Through our experience, we know that up to 50% of an advisor’s time is spent on transactional tasks, rather than strategy or business development – but it doesn’t have to be.

By PWC’s estimation, ‘more than half of the activities people are paid to perform can be automated by adopting advanced robotics and AI – either now, or surprisingly soon.’ The technology already exists to streamline these processes and accelerate the entire deal process from start to finish; the majority of advisors simply aren’t taking advantage of it yet.

2. Legacy systems are prone to risk

As technology evolves, legacy systems and processes get more out-of-date and the risk of using them increases. Advisors today connect with their clients and collaborate on documents across multiple separate systems and channels, creating a huge amount of unnecessary risk and potential for human error. Gathering and organizing this information manually makes it nearly impossible for one individual to maintain control and accountability.

Advisors spend 25% more time on compliance-related issues today than they did two years ago. Regulatory changes are the new norm, and the stakes for error are higher than they’ve ever been. The cost of re-doing work, repeating tasks or in extreme cases, paying for legal fees can be enough to force an advisory to close its doors.

3. The competition is already on to ‘new and improved’

The longer you wait to use AI technologies to get the upper hand in deals, the more you stand to lose.

-

By 2020, predictive analytics will attract 40% of the new investment made by enterprises in the areas of business intelligence and analytics. (Narrative Science)

-

By 2030, AI will drive GDP gains of $15.7 trillion. (PWC)

-

By 2035, AI could double annual economic growth rates. (Accenture)

Advisors need to be ready for change. The alternative is playing catch up when the marketplace is barely recognizable, and that’s going to end up costing a lot more.

4. Legacy systems limit innovation

Operating with the same old systems you’ve always used makes it impossible to stay ahead of the changing needs of the market. According to PWC’s Technology 2020 and Beyond, ‘legacy systems may be limiting your ability to roll out new competitive features or service offerings, and they are also limiting the ability to compete on cost.’

Given how long it takes most of these outdated systems to develop and release upgrades, investing time and resources into maintaining these systems keeps dealmakers permanently behind. And, less likely (or simply too busy) to look to the long-term benefits and value that innovative new technologies can bring.

Imagine if you could do an extra deal a year

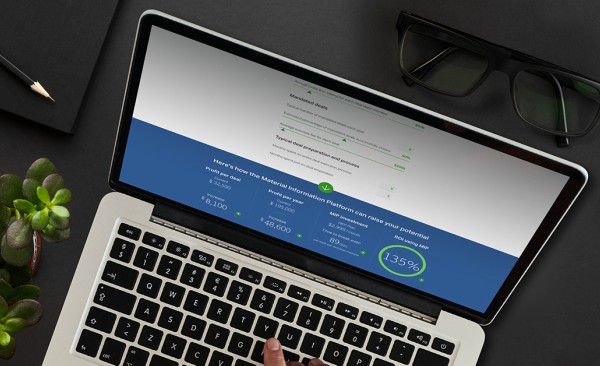

The Material Information Platform transforms the way advisors operate by bringing together all their relevant client and material information into a single portal that delivers a 360° view of activity and insights.

The Platform simplifies, accelerates and improves processes by enabling secure collaboration and task automation. It provides real-time data-driven insights, highlighting risks and opportunities, and giving advisors the foresight to act quickly and make decisions with certainty.

Our conservative estimate is that the Platform can give advisors a minimum time savings of 2 hours per week, per deal team member, for the duration of each deal.

Wasting time on inefficient processes doesn’t add up

To find out how much time and cost you could save on your next deal, try out our new deal efficiency calculator. Calculate your potential ROI increase from the Material Information Platform and find out exactly how much you’re leaving behind. A simple calculation could save you millions.